E-commerce businesses have unique financial management needs, and accounting plays a critical role in meeting these needs. From tracking cash flow to preparing for tax season, the importance of accounting in e-commerce cannot be overstated.

Unfortunately, many people are interested in starting an online business, including online stores, while many are unfamiliar with accounting and its importance. Luckily, there is a simple solution that you can use, which is the implementation of ecommerce accounting software. Here are the main reasons why dealing with accounting is so important in ecommerce.

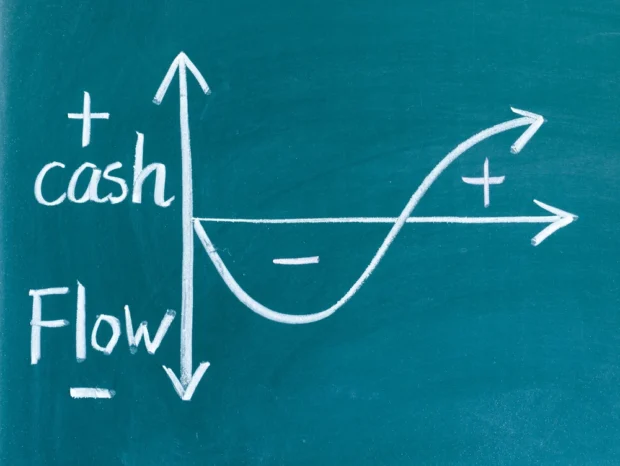

1. Monitoring Cash Flow

E-commerce businesses must be aware of the flow of money in and out of their operations to make informed decisions. Accounting provides valuable insights into cash flow, allowing entrepreneurs to monitor incoming and outgoing funds. This information can help them prioritize spending, avoid overspending, and ensure they have enough cash to meet their obligations.

In addition to tracking cash flow, accounting can also help businesses better understand their spending patterns. By identifying trends in spending, entrepreneurs can make data-driven decisions about their finances and allocate resources more effectively.

2. Tracking Expenses

Expense tracking is another critical aspect of accounting in e-commerce. Keeping a record of all operational expenses, such as inventory, shipping, and advertising, helps entrepreneurs understand their spending clearly. Accurate expense tracking allows businesses to identify areas where they can optimize spending, avoid overspending, and maintain profitability.

Accurate expense tracking can also help them prepare for tax season. By clearly understanding their expenses, entrepreneurs can ensure that they comply with tax laws and avoid any penalties or fines. This information is also critical for making informed decisions about their operations’ investments, expansions, and other critical aspects.

3. Improving Inventory Management

Inventory management is critical to success. Accounting helps businesses keep track of their inventory levels, ensuring that they have enough products on hand to meet customer demand. By monitoring inventory levels, entrepreneurs can make data-driven decisions about when to restock, what products to discontinue, and which products to expand.

Moreover, proper accounting practices help e-commerce businesses track inventory costs. This information is critical for determining the cost of goods sold and calculating gross margins, which are important metrics for evaluating the overall health of a business.

4. Facilitating Tax Compliance

Tax compliance is an essential aspect of any business, and online businesses are no exception. Accounting helps them keep track of their financial transactions, ensuring that they comply with tax laws and regulations.

By keeping accurate records, you can confidently prepare for tax season, avoiding any penalties or fines. Besides, accounting can also help you take advantage of tax deductions and credits they may be eligible for. That can help reduce their tax liability and improve their bottom line.

5. Supporting Decision Making

Good financial management is critical for informed decision-making. Accounting provides entrepreneurs the data and insights to make informed decisions about their finances, operations, and growth. By clearly understanding their financial situation, entrepreneurs can make informed decisions about investments, expansions, and other critical aspects of their operations.

In addition to supporting decision-making, accounting can help you set and track goals. By having clear financial metrics, entrepreneurs can measure their progress and make adjustments to ensure they are on track to meet their goals.

6. Protecting Against Fraud

Fraud is a real risk for e-commerce businesses, and proper accounting practices can help protect against it. By keeping accurate records of financial transactions, you can detect and prevent fraudulent activity, protecting their finances and reputation. Moreover, accounting can also help detect and prevent internal fraud. By implementing checks and balances, businesses can reduce the risk of fraud and ensure that their finances are secure.

7. Attracting Investors

E-commerce businesses looking to attract investors must have strong financial management practices. Proper accounting helps businesses demonstrate financial stability, giving investors confidence in their operations.

By presenting accurate financial information, you can give potential investors a clear understanding of their financial situation and potential for growth. That can help attract investment and support growth and expansion.

8. Improving Customer Relationships

Customer relationships are critical to success. Proper accounting can help businesses manage customer relationships by providing insights into customer behavior and spending patterns. Businesses can make informed decisions about marketing, sales, and customer service by understanding their customers.

Moreover, proper accounting can help businesses manage their customer data, ensuring that they comply with privacy laws and regulations. That can help build customer trust and strengthen customer relationships.

9. Evaluating Business Performance

Proper accounting helps online businesses evaluate their performance and make informed decisions about their operations. By tracking financial metrics, such as gross margins and return on investment, entrepreneurs can measure their performance and identify areas for improvement.

Moreover, accounting can also help businesses compare their performance to industry standards, providing valuable insights into their competitive position. This information is critical for making informed decisions about their operations’ growth, expansion, and other critical aspects.

10. Planning for the Future

Furthermore, implementing accurate financial details represents a good plan for the future. By tracking their financial performance over time, businesses can identify trends and make informed predictions about their future financial performance. This information is critical for planning and budgeting, allowing businesses to allocate resources effectively and make informed decisions about investments, growth strategies, and future initiatives.

In addition, by keeping accurate records, eCommerce businesses can forecast future cash flow and identify potential challenges, allowing them to address these issues before they become a problem proactively. That can help ensure the business’s long-term success and support sustainable growth.

Last Words

Accounting is an essential aspect of e-commerce that plays a critical role in the success of businesses. From improving inventory management and facilitating tax compliance to supporting decision-making and attracting investors, proper accounting practices can help businesses thrive in the competitive e-commerce environment. In the end, by implementing effective financial management strategies, eCommerce businesses can ensure their financial stability, support their growth and expansion, and plan for a successful future.

Comeau Computing Tech Magazine 2024

Comeau Computing Tech Magazine 2024