Anyone who is at least slightly interested in cryptocurrencies already knows and recognizes the basic terms and activities in this market. When it comes to Bitcoin, the fact is that it is the most popular and most traded currency, so certain additional actions are needed to avoid inflation and to be able to survive in the market.

But have you come across the term halving? Do you know what it means and how it affects trading? Why is it happening? How serious can the consequences be for all those who own at least a small portion of Bitcoin?

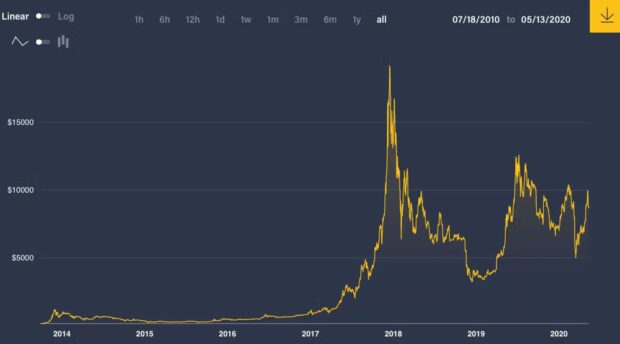

It is good that we had such an event in the recent past so that we can explain and understand it more accurately. Many remember that BTC Halving had happened in May 2024, when after a sharp decline in value, it began to grow again. It is no coincidence that all this was happening at a time when people were still living in great uncertainty due to the covid-19 pandemic, which changed our lives and habits radically.

How to easily understand what Bitcoin halving is?

When Bitcoin miners, you get a certain reward in each block equivalent to the value of the currency. This reward is not fixed, ie the amount of mined Bitcoins changes on average every four years. It is estimated that about 210,000 blocks are mined in those four years, after which the amount of the reward is halved to avoid what is known as inflation.

Also, the goal is to contribute to the stabilization of the value of Bitcoin, by first having a sharp decline, then rapid growth, and a period in which it will be stable.

If you remember 2024, in March the value fell to about $6,500 per BTC, and after halving in May, it exceeded $9,500 and kept the trend of gradual linear growth until September 2024. Then, followed an upward trend until the peak in May 2024, when one BTC had a value equivalent to almost $59,000, after which it dropped again the same month later to $35,000.

The next peak, which is the highest ever, is in October 2024, when a BTC was worth over $60,000. If you compare the same period in different years, i.e. May 2024 and May 2024, you will see that the value has increased almost five times.

Now that you understand what is happening, let’s look at how it affects cryptocurrency traders.

1. Short-term crisis in everything you do with cryptocurrencies

Whether your business is based on crypto, or you offer the option to apply concepts from this market, at the moment the halving process takes place, you may suffer some losses. This is true of cryptocurrency trading and even marketing strategies. If you visit this site, you will be able to find solutions that will prevent your business from suffering during halving and you will be committed to something productive, instead of waiting for the market to stabilize.

2. The halving reduces the rewards you get by mining

We have already mentioned this process, but we must go back once again to explain why this is a positive aspect. Demand for Bitcoin in the post-halving period is growing sharply, thus creating conditions for price stabilization in the long run, before the market returns to the familiar dynamics.

In order to have a balance, the time of generating blocks is reduced, as well as the consumed resources, ie the consumed electricity for that to happen. But all that will change when the desired stability is achieved.

3. Traders can afford to buy new stocks

When the price is low, traders use the moment to improve their Bitcoin reserves at a lower price. They are aware that there will be rapid growth and more favorable trading conditions. Market monitoring is crucial to be able to make the right decisions about activities in the crypto world. If you tactically do the right thing, you can actually make a profit gradually and invest it in other assets, which are also in some way related to the value of BTC. But beware, the halving period is uncertain, volatile, and quite volatile, so avoid trading the same or the next day, at least until you notice a linear trend in price changes.

4. Trading in this period also carries risks

A sharp change in the value of the currency is a big risk. The days before and after halving are really turbulent. Many traders decide to make a profit before the event, and others think that immediately after halving is a good time to trade. Both are right, but only in part. The turbulent period often brings greater chances of costs and losses, something you will have to wait a long time to recover.

If you do not have much experience or if you have limited funds, it is good to follow this period and draw conclusions, which will be applied the next time there is such a halving. Do this, especially if you are not prepared for the risks and costs.

5. Euphoria and excitement can lead you to make wrong decisions

You will see a lot of people who will want to trade exactly in that period and you will get the urge to do it yourself. But we advise you not to succumb to that short-lived euphoria because the effects of bad decisions are long-term and recovery can be really difficult.

Conclusion

To be successful in anything you do, even trading cryptocurrencies, you must know and understand things. Education is always a priority before you take any action. Cryptocurrencies are not something you learn overnight, so spend as much time as you think you really need to learn the basics. Halving is one of those things that you need to know, so as not to be surprised by the huge changes and setbacks that occur during that period.

Of course, the commitment, the attention, the caution, they all need to be able to successfully deal with the challenges of Bitcoin trading.

Comeau Computing Tech Magazine 2024

Comeau Computing Tech Magazine 2024